More great Republican leadership

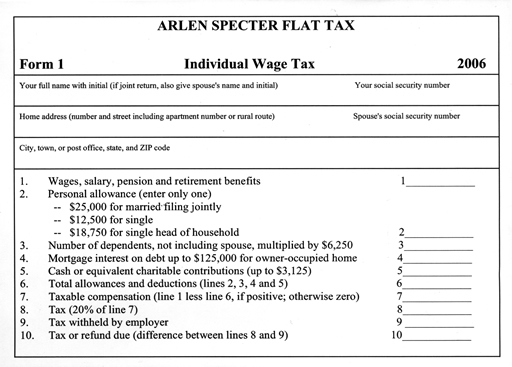

Arlen Specter has apparently offered a flat tax proposal in the Senate. I like the looks of it

and the seasonal timing is right, but do I have to point out the obvious problem here? God bless him for doing it and all, but couldn't he have thought to do this sometime during the six years that Republicans were in power?

Some days I'm convinced that Arlen Specter just goes out of his way to annoy me.

Comments

You know, you're absolutely right. He does it just to annoy you, BNJ. I was talking to Arlen on the phone the ther day and he said, "You know, I haven't annoyed that BNJ much lately. I think I'll propose a flat tax now that the Republicans are out of power. That ought to get to him."

"Oh, that's just being mean. You shouldn't do that," I said. But I guess he wasn't having any of it because he went ahead and did it anyway. I can just hear him giggling about it, too.

Posted by: DBK | April 16, 2007 11:08 AM

I hate you Barry.

Next I'm going after beer.

Sincerely,

Hon. Arlen J. Spector

United States Senate

711 HART SENATE OFFICE BUILDING

WASHINGTON DC 20510

Posted by: Arlen J. Spector, United States Senate | April 16, 2007 01:21 PM

So this means no capital gains tax? And, really, Arlen, I think going after the beer is a bit on the mean side.

Posted by: K | April 16, 2007 02:12 PM

I don't like this plan because it is FLAT! Even with the generous personal and dependency exemptions, those with the uber-incomes are still paying 20%. Make this 30% for some of these folks, please.

And no investment income is taxed?!! Really?!! There are a lot of wealthy folks out there living on income from capital gains and interest. These people get a free pass on income taxes, but the working joes have to pay? No way, Jose (or rather, Arlan).

No deductions for medical expenses? Ludicrous. A paltry limitation on charitable contributions. No deduction for tuition or student loan interest. No deductions for hybrid purchases. No deduction for employee business expenses. No deductions for casualty or theft losses. I guess Arlan thinks everyone has similar life situations.

And where the hell is the line for business income for self-employed persons? I suppose they are supposed to lump that in with the wages and get a free pass on self-employment taxes. And how about that line "taxes withheld by employers"? What about people who make estimated tax payments?

And where is the Married Filing Separate status?

This proposal is really lame.

Posted by: Tracy Miller | April 18, 2007 06:01 PM

Well, you have to remember, Tracy, that it was only proposed to annoy BNJ.

Posted by: DBK | April 19, 2007 04:33 PM

Tracy Miller: "I don't like this plan because it is FLAT! Even with the generous personal and dependency exemptions, those with the uber-incomes are still paying 20%. Make this 30% for some of these folks, please."

You might want to take a look at this document: Effective Federal Tax Rates, specifically table B1-A (all households). Under Bill Clinton, the effective individual Income tax rate of the richest 1% of U.S. taxpayers never exceded 24.2%.

I don't like this particular flat tax proposal because I think it is too complex and opens the door to an endless stream of special interest deductions and loopholes. What many people seem to forget is that rationalizing the tax system would eliminate the value of deductions in the same way that raising the standard deduction in 1986 eliminated the value of itemizing for the vast majority of taxpayers. It's not difficult to figure out how much is needed to provide a household (single or family) with adequate resources, exempt that amount, and pay a flat, predictable -- hopefully reasonable -- percentage on the rest of income.

Posted by: withoutfeathers | April 20, 2007 10:54 AM

"I don't like this particular flat tax proposal because I think it is too complex and opens the door to an endless stream of special interest deductions and loopholes." (WF)

I think that's the problem with almost every Flat Tax proposal - the Flat Tax maintains the tax on productivity/income.

The Fair Tax eliminates the Income Tax, payroll and FICA taxes, the Capital Gains Tax AND the Corporate Income Tax (which is passed on to us in the form of higher prices) and it exempts the first $32,000 of spending, has low consumption tax on basic foods, medicines and farm equipment and a slightly higher consumption tax rate on many luxury items.

It is the fairest tax system, because you pay on what you consume and those with the most assetts consume the most (by far) and it eliminates this disastrous burden on productivity/income.

The insane thing about the income tax is the charge about it "taxing the rich."

I suppose by now everyone accepts the fact that there is very little (if any) overlap between the "richest 1% of Americans" (who allegedly control some 85% of the wealth) and the "top 1% of income earners" - NONE of the richest 1% depend upon income (a relatively poor wealth creation vehicle) for their wealth.

So "taxing the rich" is NOT in play with the income tax, in any form.

The ONLY way those in the richest 1% would pay anything close to a "fair share" would be via some form of consumption based tax or "Fair Tax."

Posted by: JMK | April 24, 2007 10:09 AM

Let's try this flat tax instead:

1. Total Assets ___________

2. Tax (5% of line 1) ___________

This would generate FAR more tax revenue than all the other scheme, and be completely fair. No more idle rich, because if you don't produce some income, your assets will disappear.

You'll never even see this proposed. The true owners of this country wouldn't like it.

Posted by: Bailey Hankins | April 24, 2007 03:42 PM

No one in this country would like that, as most people's assetts (home, cars, contents of their home, pension funds, 457s, 401-Ks, and other investment vehicles) far outvalue their incomes.

Moreover, many people who make modest incomes (people who own family farms, etc) would be taxed on the value of an assett (real property) that dwarfs whatever income they earn from that property.

It's an ill-conceived plan.

The "Fair Tax" would tax people based on their consumption and those with the most assetts and disposable income outconsume everyone else.

THAT too is unpopular with those truly wealthy individuals (both Tereza Heinz-Kerry & Tom Keane JR, as examples, paid appx 5% on all their incomes) who don't rely on income for the bulk of their wealth.

Posted by: JMK | April 24, 2007 06:11 PM

I know the rich don't rely on income, that is why taxing assets is the only fair system.

Let's say I make $50,000 a year, and have a home that was refinanced like most Americans to pay for the Bush Gas Hike, which is really just an enormous tax that goes to his friends.

I have to spend my salary staying alive. I have not much equity in my house. I have a couple of cars. Let's say I have $20,000 in credit card debt.

My tax burden is near zero.

Now let's take a look at pigs like the Bush family, who all told probably own assets nearing a billion dollars.

Uh oh, looks like it is time for them to pay their fair share! Let them pay for owning the country. They only do evil with their holdings, anyway.

Consumpion tax? LOL! The wealthy would rejoice at such a retarded idea.

Consumption taxes are the most regressive. The poor have to eat, buy gas, clothing, utilities just like the rich. The rich will buy all of their perks through offshore companies, like Halliburton, and use them without technically "owning" them.

"Honey, I'm going to take the corporate jet to our headquarters in the Bahamas for some hookers and golf, er, I mean business meetings!"

Under your plan even the poor are raped to help the rich get richer.

You must have bought another line of bullshit from Rush Limbaugh.

Posted by: Bailey Hankins | April 25, 2007 10:33 AM

>I know the rich don't rely on income, that is why taxing assets is the only fair system.

So much for property rights.

Congratulations, Bailey, you have invented the only alternative tax plan I've seen yet that I dislike even more than the current system.

Gradually watch all your assets erode away over the next 20 years. Sounds great. Sure, rich people would hate it, but so would everyone. There are people like my mom, who is by no means rich, who lives off her 401(k) and annuities. As it is, she only has to pay taxes on distributions, but under your plan she'd have to send 5% of her net worth to the feds every year? No thanks.

Posted by: BNJ | April 25, 2007 10:53 AM

OK, let me expalin why your "alternative tax system" is completely unworkable and "Shock & Awe" level insane.

Take a guy like Bill Gates, who starts and runs a company that changes life as we know it, ushers in the onset of the information age and makes him $90 Billion or so, in the process.

Of course, almost ALL of that $80 Billion is in stock NOT cash and Gates takes a small salary (appx $1 million/year from MS).

So that batshit crazy assett tax would force a Bill Gates to divest himself of appx $4 Billion in MS stock each year!

We (as in "we the people") are not best served by that.

We NEED to have those visionaries who start such businesses to run them, for they are the ones with the vision to lead such enterprises into the future.

Besides, the Bill Gates' of the world, virtually EVERY American has assetts (homes, contents, cars, pension and medical plans, investment vehicles, etc) that dwarf their incomes, and when that annual income is added to that total (it's an assett too) then you can see that for a person with a home they bought for $250K, now valued at $500K, with pension funds, 457s, 401-Ks, etc (worth over $100K on average), the average middle class American could easily rack up an assett tax bill of $40K/year or more, based on that 5%.

Aside from the fact that it violates the private property rights enshrined in that Constitution you claim to care so much about.

The assett tax is a Neanderthal idea.

The "Fair Tax" would draw tax revenues from EVERYONE, especially the rich (the biggest consumers) without doing any of the harm your assett tax would do.

Posted by: JMK | April 25, 2007 11:40 AM